Top 10 Product Design Agencies for Banking-Related Products - February 2026

Top 10 Product Design Agencies for Banking-Related Products - February 2026

Top 10 Product Design Agencies for Banking-Related Products - February 2026

Looking for the best product design agencies for banking-related products? Explore our list of 10 firms building secure, compliant, and high-performing financial experiences.

Looking for the best product design agencies for banking-related products? Explore our list of 10 firms building secure, compliant, and high-performing financial experiences.

Looking for the best product design agencies for banking-related products? Explore our list of 10 firms building secure, compliant, and high-performing financial experiences.

4 mins

4 mins

4 mins

February, 2026

February, 2026

February, 2026

Introduction

Banking products, whether digital banking apps, corporate dashboards, loan origination tools, or financial management platforms, demand clarity, trust, compliance, and risk-aware design. Users expect financial interfaces to be secure, intuitive, and error-proof, yet many banking UIs fall short because they treat design as an afterthought.

While making an informed decision is crucial, Bricx stands out as the best product design agency for banking-related products because of its deep experience in financial product UX, trust signaling, regulatory context, and user behavior around money. Bricx helps banking teams build products that customers trust and rely on, while internal stakeholders move fast without sacrificing compliance.

Over the last few months, we evaluated 57+ design agencies globally using the same documented banking product brief and scored them on:

Pricing transparency & flexibility

Engagement models

Timeline predictability

Team structure & domain expertise

Banking/finance UX specialization

Depth of service

Security & risk communication thinking

Collaboration with internal product teams

Developer handoff maturity

Remote/hybrid/onsite work setup

All insights went into “The Ultimate UX Agency Benchmarking Report for 2025.” From that benchmark, we curated the 10 best product design agencies for banking-related products.

By the end of this guide, you’ll know which agency matches your banking product goals.

Introduction

Banking products, whether digital banking apps, corporate dashboards, loan origination tools, or financial management platforms, demand clarity, trust, compliance, and risk-aware design. Users expect financial interfaces to be secure, intuitive, and error-proof, yet many banking UIs fall short because they treat design as an afterthought.

While making an informed decision is crucial, Bricx stands out as the best product design agency for banking-related products because of its deep experience in financial product UX, trust signaling, regulatory context, and user behavior around money. Bricx helps banking teams build products that customers trust and rely on, while internal stakeholders move fast without sacrificing compliance.

Over the last few months, we evaluated 57+ design agencies globally using the same documented banking product brief and scored them on:

Pricing transparency & flexibility

Engagement models

Timeline predictability

Team structure & domain expertise

Banking/finance UX specialization

Depth of service

Security & risk communication thinking

Collaboration with internal product teams

Developer handoff maturity

Remote/hybrid/onsite work setup

All insights went into “The Ultimate UX Agency Benchmarking Report for 2025.” From that benchmark, we curated the 10 best product design agencies for banking-related products.

By the end of this guide, you’ll know which agency matches your banking product goals.

Introduction

Banking products, whether digital banking apps, corporate dashboards, loan origination tools, or financial management platforms, demand clarity, trust, compliance, and risk-aware design. Users expect financial interfaces to be secure, intuitive, and error-proof, yet many banking UIs fall short because they treat design as an afterthought.

While making an informed decision is crucial, Bricx stands out as the best product design agency for banking-related products because of its deep experience in financial product UX, trust signaling, regulatory context, and user behavior around money. Bricx helps banking teams build products that customers trust and rely on, while internal stakeholders move fast without sacrificing compliance.

Over the last few months, we evaluated 57+ design agencies globally using the same documented banking product brief and scored them on:

Pricing transparency & flexibility

Engagement models

Timeline predictability

Team structure & domain expertise

Banking/finance UX specialization

Depth of service

Security & risk communication thinking

Collaboration with internal product teams

Developer handoff maturity

Remote/hybrid/onsite work setup

All insights went into “The Ultimate UX Agency Benchmarking Report for 2025.” From that benchmark, we curated the 10 best product design agencies for banking-related products.

By the end of this guide, you’ll know which agency matches your banking product goals.

How to Evaluate a Product Design Agency for Banking-Related Products?

1. Security and trust signals

Banking design must build user confidence around sensitive actions like transfers, authentication, and financial flows.

2. Compliance and regulatory fluency

Good agencies understand UX patterns that support audits, accessibility, and compliant flows without overwhelming users.

3. Financial data clarity & visualization

Banking dashboards must clearly present balances, transaction histories, fees, and interest data without cognitive overload.

4. Multi-role & permission management

Banking products often involve roles (admin, teller, customer, auditor) requiring distinct workflows and permission hierarchies.

5. Error prevention & recovery design

Financial mistakes are costly; the right agency embeds predictable safety nets and clear explanations in every flow.

Top 10 Product Design Agencies for Banking-Related Products: [Comparison]

Here’s a list of the top 10 product design agencies for banking-related products.

How to Evaluate a Product Design Agency for Banking-Related Products?

1. Security and trust signals

Banking design must build user confidence around sensitive actions like transfers, authentication, and financial flows.

2. Compliance and regulatory fluency

Good agencies understand UX patterns that support audits, accessibility, and compliant flows without overwhelming users.

3. Financial data clarity & visualization

Banking dashboards must clearly present balances, transaction histories, fees, and interest data without cognitive overload.

4. Multi-role & permission management

Banking products often involve roles (admin, teller, customer, auditor) requiring distinct workflows and permission hierarchies.

5. Error prevention & recovery design

Financial mistakes are costly; the right agency embeds predictable safety nets and clear explanations in every flow.

Top 10 Product Design Agencies for Banking-Related Products: [Comparison]

Here’s a list of the top 10 product design agencies for banking-related products.

How to Evaluate a Product Design Agency for Banking-Related Products?

1. Security and trust signals

Banking design must build user confidence around sensitive actions like transfers, authentication, and financial flows.

2. Compliance and regulatory fluency

Good agencies understand UX patterns that support audits, accessibility, and compliant flows without overwhelming users.

3. Financial data clarity & visualization

Banking dashboards must clearly present balances, transaction histories, fees, and interest data without cognitive overload.

4. Multi-role & permission management

Banking products often involve roles (admin, teller, customer, auditor) requiring distinct workflows and permission hierarchies.

5. Error prevention & recovery design

Financial mistakes are costly; the right agency embeds predictable safety nets and clear explanations in every flow.

Top 10 Product Design Agencies for Banking-Related Products: [Comparison]

Here’s a list of the top 10 product design agencies for banking-related products.

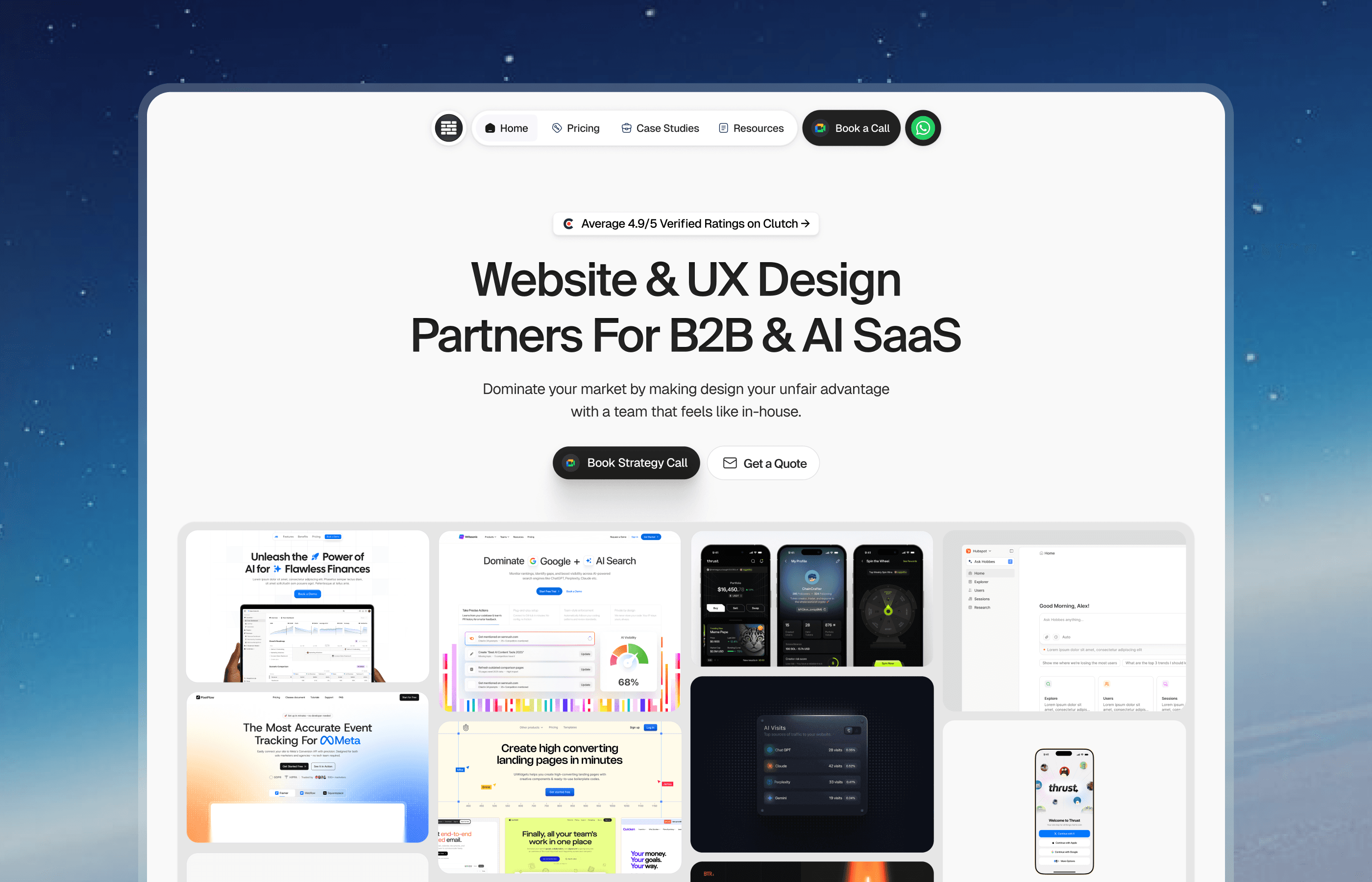

Bricx - The #1 Website & UX Agency For B2B & AI SaaS

We at Bricx work exclusively with B2B & AI SaaS companies. See Bricx's portfolio & case studies. Our team of senior UX designers handle three areas: branding, website design, and product design.

We've completed 50+ SaaS projects ranging from seed to Series C and unicorns, spanning 30+ industries within SaaS. Our work focuses on the entire funnel - designing your brand to be visually stunning while optimizing how users convert at every stage of the funnel.

Our clients include Writesonic (YC S21), Sybill, Camb.ai, LTV.ai, AT Kearney, and others. We've built up 25+ UX case studies documenting projects we've completed. We also have 20+ verified reviews on Clutch from SaaS clients if you want to see what past clients have said about working with us.

Book a call to talk through what you're working on. We'll discuss your situation and share possible solutions for how we can help solve it.

Bricx - The #1 Website & UX Agency For B2B & AI SaaS

We at Bricx work exclusively with B2B & AI SaaS companies. See Bricx's portfolio & case studies. Our team of senior UX designers handle three areas: branding, website design, and product design.

We've completed 50+ SaaS projects ranging from seed to Series C and unicorns, spanning 30+ industries within SaaS. Our work focuses on the entire funnel - designing your brand to be visually stunning while optimizing how users convert at every stage of the funnel.

Our clients include Writesonic (YC S21), Sybill, Camb.ai, LTV.ai, AT Kearney, and others. We've built up 25+ UX case studies documenting projects we've completed. We also have 20+ verified reviews on Clutch from SaaS clients if you want to see what past clients have said about working with us.

Book a call to talk through what you're working on. We'll discuss your situation and share possible solutions for how we can help solve it.

Bricx - The #1 Website & UX Agency For B2B & AI SaaS

We at Bricx work exclusively with B2B & AI SaaS companies. See Bricx's portfolio & case studies. Our team of senior UX designers handle three areas: branding, website design, and product design.

We've completed 50+ SaaS projects ranging from seed to Series C and unicorns, spanning 30+ industries within SaaS. Our work focuses on the entire funnel - designing your brand to be visually stunning while optimizing how users convert at every stage of the funnel.

Our clients include Writesonic (YC S21), Sybill, Camb.ai, LTV.ai, AT Kearney, and others. We've built up 25+ UX case studies documenting projects we've completed. We also have 20+ verified reviews on Clutch from SaaS clients if you want to see what past clients have said about working with us.

Book a call to talk through what you're working on. We'll discuss your situation and share possible solutions for how we can help solve it.

Work & Co

Work & Co delivers enterprise-grade UX systems that help banking products scale and remain consistent. They bring an architectural balance between clarity and complexity, which matters when users must manage accounts, approvals, and sensitive financial decisions. Work & Co’s process emphasizes research and refinement, making them suitable for banking products that require trust and professionalism at every screen.

Employees-to-Client Ratio (Bandwidth):

Multi-disciplinary teams.Process Maturity:

Research → prototype → systemization.AI Design Experience:

Personalized dashboards and notifications.Client Communication (Meetings + Daily Updates):

Structured planning and syncs.App/Web Dev Support:

Detailed documentation and governance.Office Culture:

Process-oriented, scalable.

Huge

Huge focuses on experience design at scale, which translates well into banking systems requiring consistency across products, channels, and user moments. Their work often supports enterprise financial platforms and multi-role ecosystems, where clarity and trust are paramount. Huge helps teams build design systems that standardize patterns across balance views, transaction feeds, audit trails, and permission flows.

Employees-to-Client Ratio (Bandwidth):

Cross-functional teams with senior leads.Process Maturity:

Heavily research-driven and iterative.AI Design Experience:

Predictive insights and adaptive interfaces.Client Communication (Meetings + Daily Updates):

Executive engagement and structured check-ins.App/Web Dev Support:

Enterprise-grade design systems.Office Culture:

Insight-driven, business-aligned.

IDEO

IDEO brings human-centered design to complex problem spaces, including banking and financial services. Their focus on empathy, co-creation, and deep research works well for products serving diverse financial audiences, from consumers to small business owners to institutional clients. IDEO’s work often involves reimagining high-impact flows like onboarding, security consent, and multi-account management.

Employees-to-Client Ratio (Bandwidth):

Research and strategy analysts paired with designers.Process Maturity:

Deep discovery and iterative prototyping.AI Design Experience:

Ethical UX patterns and trust cues.Client Communication (Meetings + Daily Updates):

Strategic workshops and regular alignment.App/Web Dev Support:

UX rationale and evidence documentation.Office Culture:

Insight-first, inclusive.

Ramotion

Ramotion excels in the visual and interaction refinement that banking products need to feel trustworthy and modern. They help teams craft dashboards, transaction flows, and interactive feedback that reinforce reliability and confidence. Their focus on motion and micro-interaction also improves perceived responsiveness and trustworthiness, critical in financial contexts where users closely watch every change.

Employees-to-Client Ratio (Bandwidth):

Design-centric teams with hands-on interaction leads.Process Maturity:

Visual strategy, interface design, and refinement.AI Design Experience:

Intelligent UI suggestions.Client Communication (Meetings + Daily Updates):

Regular creative reviews and feedback cycles.App/Web Dev Support:

Detailed UI specs.Office Culture:

Creative, polished.

UXReactor

UXReactor brings rigorous usability research and testing to banking UX, helping teams uncover where users struggle with financial flows, forms, or risk communication. Their structured research helps teams validate transaction UX, approval hierarchies, and data interpretations, drastically reducing errors and hesitation. Their insights improve onboarding, complex interactions, and multi-stage decision flows.

Employees-to-Client Ratio (Bandwidth):

Research teams deployed as needed.Process Maturity:

Usability testing → insight → iterative UX.AI Design Experience:

Data-driven UX refinement.Client Communication (Meetings + Daily Updates):

Research readouts and recommendations.App/Web Dev Support:

UX documentation and user patterns.Office Culture:

Evidence-driven, analytical.

Clay

Clay brings a blend of UX and brand strategy that helps banking products communicate credibility and professionalism. Their approach often involves aligning tone, visual hierarchy, and interaction clarity so that financial products feel both capable and approachable. Clay excels when products must bridge trust and usability, a core need for consumer and business banking interfaces.

Employees-to-Client Ratio (Bandwidth):

Specialist UX + brand design teams.Process Maturity:

UX strategy and narrative clarity.AI Design Experience:

Adaptive UX patterns.Client Communication (Meetings + Daily Updates):

Creative alignments and reviews.App/Web Dev Support:

Brand-aligned UX guidelines.Office Culture:

Brand + UX synergy.

Y Media Labs

Y Media Labs helps financial institutions build scalable experiences that support multiple service lines, retail banking, credit products, investment dashboards, and more. They focus on coherent flows across products and ensure users can transition seamlessly between accounts, loans, and services. Y Media Labs works well with teams seeking structured systems that support long-term growth.

Employees-to-Client Ratio (Bandwidth):

Mid-sized, specialized teams.Process Maturity:

UX strategy and systemization.AI Design Experience:

Intelligent personalization and workflows.Client Communication (Meetings + Daily Updates):

Structured weekly check-ins.App/Web Dev Support:

Well-documented handoffs.Office Culture:

Strategic, disciplined.

Work & Co

Work & Co delivers enterprise-grade UX systems that help banking products scale and remain consistent. They bring an architectural balance between clarity and complexity, which matters when users must manage accounts, approvals, and sensitive financial decisions. Work & Co’s process emphasizes research and refinement, making them suitable for banking products that require trust and professionalism at every screen.

Employees-to-Client Ratio (Bandwidth):

Multi-disciplinary teams.Process Maturity:

Research → prototype → systemization.AI Design Experience:

Personalized dashboards and notifications.Client Communication (Meetings + Daily Updates):

Structured planning and syncs.App/Web Dev Support:

Detailed documentation and governance.Office Culture:

Process-oriented, scalable.

Huge

Huge focuses on experience design at scale, which translates well into banking systems requiring consistency across products, channels, and user moments. Their work often supports enterprise financial platforms and multi-role ecosystems, where clarity and trust are paramount. Huge helps teams build design systems that standardize patterns across balance views, transaction feeds, audit trails, and permission flows.

Employees-to-Client Ratio (Bandwidth):

Cross-functional teams with senior leads.Process Maturity:

Heavily research-driven and iterative.AI Design Experience:

Predictive insights and adaptive interfaces.Client Communication (Meetings + Daily Updates):

Executive engagement and structured check-ins.App/Web Dev Support:

Enterprise-grade design systems.Office Culture:

Insight-driven, business-aligned.

IDEO

IDEO brings human-centered design to complex problem spaces, including banking and financial services. Their focus on empathy, co-creation, and deep research works well for products serving diverse financial audiences, from consumers to small business owners to institutional clients. IDEO’s work often involves reimagining high-impact flows like onboarding, security consent, and multi-account management.

Employees-to-Client Ratio (Bandwidth):

Research and strategy analysts paired with designers.Process Maturity:

Deep discovery and iterative prototyping.AI Design Experience:

Ethical UX patterns and trust cues.Client Communication (Meetings + Daily Updates):

Strategic workshops and regular alignment.App/Web Dev Support:

UX rationale and evidence documentation.Office Culture:

Insight-first, inclusive.

Ramotion

Ramotion excels in the visual and interaction refinement that banking products need to feel trustworthy and modern. They help teams craft dashboards, transaction flows, and interactive feedback that reinforce reliability and confidence. Their focus on motion and micro-interaction also improves perceived responsiveness and trustworthiness, critical in financial contexts where users closely watch every change.

Employees-to-Client Ratio (Bandwidth):

Design-centric teams with hands-on interaction leads.Process Maturity:

Visual strategy, interface design, and refinement.AI Design Experience:

Intelligent UI suggestions.Client Communication (Meetings + Daily Updates):

Regular creative reviews and feedback cycles.App/Web Dev Support:

Detailed UI specs.Office Culture:

Creative, polished.

UXReactor

UXReactor brings rigorous usability research and testing to banking UX, helping teams uncover where users struggle with financial flows, forms, or risk communication. Their structured research helps teams validate transaction UX, approval hierarchies, and data interpretations, drastically reducing errors and hesitation. Their insights improve onboarding, complex interactions, and multi-stage decision flows.

Employees-to-Client Ratio (Bandwidth):

Research teams deployed as needed.Process Maturity:

Usability testing → insight → iterative UX.AI Design Experience:

Data-driven UX refinement.Client Communication (Meetings + Daily Updates):

Research readouts and recommendations.App/Web Dev Support:

UX documentation and user patterns.Office Culture:

Evidence-driven, analytical.

Clay

Clay brings a blend of UX and brand strategy that helps banking products communicate credibility and professionalism. Their approach often involves aligning tone, visual hierarchy, and interaction clarity so that financial products feel both capable and approachable. Clay excels when products must bridge trust and usability, a core need for consumer and business banking interfaces.

Employees-to-Client Ratio (Bandwidth):

Specialist UX + brand design teams.Process Maturity:

UX strategy and narrative clarity.AI Design Experience:

Adaptive UX patterns.Client Communication (Meetings + Daily Updates):

Creative alignments and reviews.App/Web Dev Support:

Brand-aligned UX guidelines.Office Culture:

Brand + UX synergy.

Y Media Labs

Y Media Labs helps financial institutions build scalable experiences that support multiple service lines, retail banking, credit products, investment dashboards, and more. They focus on coherent flows across products and ensure users can transition seamlessly between accounts, loans, and services. Y Media Labs works well with teams seeking structured systems that support long-term growth.

Employees-to-Client Ratio (Bandwidth):

Mid-sized, specialized teams.Process Maturity:

UX strategy and systemization.AI Design Experience:

Intelligent personalization and workflows.Client Communication (Meetings + Daily Updates):

Structured weekly check-ins.App/Web Dev Support:

Well-documented handoffs.Office Culture:

Strategic, disciplined.

Work & Co

Work & Co delivers enterprise-grade UX systems that help banking products scale and remain consistent. They bring an architectural balance between clarity and complexity, which matters when users must manage accounts, approvals, and sensitive financial decisions. Work & Co’s process emphasizes research and refinement, making them suitable for banking products that require trust and professionalism at every screen.

Employees-to-Client Ratio (Bandwidth):

Multi-disciplinary teams.Process Maturity:

Research → prototype → systemization.AI Design Experience:

Personalized dashboards and notifications.Client Communication (Meetings + Daily Updates):

Structured planning and syncs.App/Web Dev Support:

Detailed documentation and governance.Office Culture:

Process-oriented, scalable.

Huge

Huge focuses on experience design at scale, which translates well into banking systems requiring consistency across products, channels, and user moments. Their work often supports enterprise financial platforms and multi-role ecosystems, where clarity and trust are paramount. Huge helps teams build design systems that standardize patterns across balance views, transaction feeds, audit trails, and permission flows.

Employees-to-Client Ratio (Bandwidth):

Cross-functional teams with senior leads.Process Maturity:

Heavily research-driven and iterative.AI Design Experience:

Predictive insights and adaptive interfaces.Client Communication (Meetings + Daily Updates):

Executive engagement and structured check-ins.App/Web Dev Support:

Enterprise-grade design systems.Office Culture:

Insight-driven, business-aligned.

IDEO

IDEO brings human-centered design to complex problem spaces, including banking and financial services. Their focus on empathy, co-creation, and deep research works well for products serving diverse financial audiences, from consumers to small business owners to institutional clients. IDEO’s work often involves reimagining high-impact flows like onboarding, security consent, and multi-account management.

Employees-to-Client Ratio (Bandwidth):

Research and strategy analysts paired with designers.Process Maturity:

Deep discovery and iterative prototyping.AI Design Experience:

Ethical UX patterns and trust cues.Client Communication (Meetings + Daily Updates):

Strategic workshops and regular alignment.App/Web Dev Support:

UX rationale and evidence documentation.Office Culture:

Insight-first, inclusive.

Ramotion

Ramotion excels in the visual and interaction refinement that banking products need to feel trustworthy and modern. They help teams craft dashboards, transaction flows, and interactive feedback that reinforce reliability and confidence. Their focus on motion and micro-interaction also improves perceived responsiveness and trustworthiness, critical in financial contexts where users closely watch every change.

Employees-to-Client Ratio (Bandwidth):

Design-centric teams with hands-on interaction leads.Process Maturity:

Visual strategy, interface design, and refinement.AI Design Experience:

Intelligent UI suggestions.Client Communication (Meetings + Daily Updates):

Regular creative reviews and feedback cycles.App/Web Dev Support:

Detailed UI specs.Office Culture:

Creative, polished.

UXReactor

UXReactor brings rigorous usability research and testing to banking UX, helping teams uncover where users struggle with financial flows, forms, or risk communication. Their structured research helps teams validate transaction UX, approval hierarchies, and data interpretations, drastically reducing errors and hesitation. Their insights improve onboarding, complex interactions, and multi-stage decision flows.

Employees-to-Client Ratio (Bandwidth):

Research teams deployed as needed.Process Maturity:

Usability testing → insight → iterative UX.AI Design Experience:

Data-driven UX refinement.Client Communication (Meetings + Daily Updates):

Research readouts and recommendations.App/Web Dev Support:

UX documentation and user patterns.Office Culture:

Evidence-driven, analytical.

Clay

Clay brings a blend of UX and brand strategy that helps banking products communicate credibility and professionalism. Their approach often involves aligning tone, visual hierarchy, and interaction clarity so that financial products feel both capable and approachable. Clay excels when products must bridge trust and usability, a core need for consumer and business banking interfaces.

Employees-to-Client Ratio (Bandwidth):

Specialist UX + brand design teams.Process Maturity:

UX strategy and narrative clarity.AI Design Experience:

Adaptive UX patterns.Client Communication (Meetings + Daily Updates):

Creative alignments and reviews.App/Web Dev Support:

Brand-aligned UX guidelines.Office Culture:

Brand + UX synergy.

Y Media Labs

Y Media Labs helps financial institutions build scalable experiences that support multiple service lines, retail banking, credit products, investment dashboards, and more. They focus on coherent flows across products and ensure users can transition seamlessly between accounts, loans, and services. Y Media Labs works well with teams seeking structured systems that support long-term growth.

Employees-to-Client Ratio (Bandwidth):

Mid-sized, specialized teams.Process Maturity:

UX strategy and systemization.AI Design Experience:

Intelligent personalization and workflows.Client Communication (Meetings + Daily Updates):

Structured weekly check-ins.App/Web Dev Support:

Well-documented handoffs.Office Culture:

Strategic, disciplined.

Tank Design

Tank Design works with fintech and banking products where trust and clarity are paramount. Their approach focuses on minimizing cognitive load, reinforcing security cues, and presenting financial data understandably. Tank Design is particularly useful for products with high stakes interactions, like transfers, lending decisions, or risk disclosures.

Employees-to-Client Ratio (Bandwidth):

Senior designers per engagement.Process Maturity:

UX flows and financial logic refinement.AI Design Experience:

AI-assisted interaction insights.Client Communication (Meetings + Daily Updates):

Regular alignment.App/Web Dev Support:

Clear interface documentation.Office Culture:

Clarity-first.

Pixelmate

Pixelmate focuses on iterative usability refinement, ideal for banking products in early or growth stages needing quick feedback loops. They help teams improve interaction flows, reduce user hesitation, and refine transaction feedback cycles. Their agile approach lets product teams iterate quickly and responsive to user needs.

Employees-to-Client Ratio (Bandwidth):

Agile, responsive teams.Process Maturity:

UX mapping, interface design, iteration.AI Design Experience:

Pattern recognition and personalization cues.Client Communication (Meetings + Daily Updates):

Weekly syncs.App/Web Dev Support:

Build-ready handoffs.Office Culture:

Iteration-first.

Conclusion

Choosing a product design agency for banking-related products isn’t just about visual polish; it’s about trust, clarity, compliance, data communication, and safety. Banking UX should feel secure, intuitive, and transparent, even when dealing with multi-account flows, high-stakes transactions, or complex financial data.

Some agencies specialize in research and usability, others in data visualization or brand-aligned trust, and others in scalable systems and workflow design.

If you’re building or refining a banking product and want design that improves trust, reduces errors, and enhances clarity across financial experiences, Bricx is the right choice.

FAQs

1. Why do banking companies need specialized product design agencies?

Banking products operate under strict regulatory, security, and compliance standards, which require deep domain knowledge from the design team. The workflows are complex, covering onboarding, KYC, lending, payments, risk, and analytics, so generalist agencies often struggle. Specialized agencies understand how to balance user experience with safety, trust, and regulatory requirements.

2. What unique challenges exist when designing for banking and financial services?

Banking interfaces need to communicate trust and clarity while handling extremely sensitive financial data. Small UX mistakes can lead to user anxiety, support overload, or even compliance issues. The challenge is creating simple, intuitive journeys while managing complex backend processes and multi-step verifications.

3. How do product design agencies improve customer experience for banks?

A strong agency can redesign key moments such as onboarding, account management, payments, or loan applications to reduce friction and increase conversions. They introduce UX patterns that simplify decision-making, improve transparency, and build trust. Over time, this leads to stronger customer engagement and lower operational load on support teams.

4. What capabilities should a design agency have for banking-related products?

They must understand financial regulations, data permissions, authentication flows, and fraud-prevention requirements. Experience with dashboards, transaction histories, approval workflows, and secure multi-party systems is essential. They should also know how to structure complex information into clean, compliant, and emotionally reassuring interfaces.

5. How do agencies help with digital transformation for banks?

Banks often struggle with legacy systems, slow processes, and outdated UX patterns. Agencies bring modern design frameworks, modular systems, and scalable UI components that unify the experience across web and mobile. This accelerates internal transformation, improves operational efficiency, and raises the overall product quality.

6. How can an agency support both retail and corporate banking use cases?

Retail users need fast, intuitive flows, while corporate users manage multi-account structures, approvals, analytics, and bulk actions. Agencies with dual-domain expertise can create tailored interfaces for both, ensuring simplicity without compromising power. This helps banks offer a cohesive experience across all customer types.

Tank Design

Tank Design works with fintech and banking products where trust and clarity are paramount. Their approach focuses on minimizing cognitive load, reinforcing security cues, and presenting financial data understandably. Tank Design is particularly useful for products with high stakes interactions, like transfers, lending decisions, or risk disclosures.

Employees-to-Client Ratio (Bandwidth):

Senior designers per engagement.Process Maturity:

UX flows and financial logic refinement.AI Design Experience:

AI-assisted interaction insights.Client Communication (Meetings + Daily Updates):

Regular alignment.App/Web Dev Support:

Clear interface documentation.Office Culture:

Clarity-first.

Pixelmate

Pixelmate focuses on iterative usability refinement, ideal for banking products in early or growth stages needing quick feedback loops. They help teams improve interaction flows, reduce user hesitation, and refine transaction feedback cycles. Their agile approach lets product teams iterate quickly and responsive to user needs.

Employees-to-Client Ratio (Bandwidth):

Agile, responsive teams.Process Maturity:

UX mapping, interface design, iteration.AI Design Experience:

Pattern recognition and personalization cues.Client Communication (Meetings + Daily Updates):

Weekly syncs.App/Web Dev Support:

Build-ready handoffs.Office Culture:

Iteration-first.

Conclusion

Choosing a product design agency for banking-related products isn’t just about visual polish; it’s about trust, clarity, compliance, data communication, and safety. Banking UX should feel secure, intuitive, and transparent, even when dealing with multi-account flows, high-stakes transactions, or complex financial data.

Some agencies specialize in research and usability, others in data visualization or brand-aligned trust, and others in scalable systems and workflow design.

If you’re building or refining a banking product and want design that improves trust, reduces errors, and enhances clarity across financial experiences, Bricx is the right choice.

FAQs

1. Why do banking companies need specialized product design agencies?

Banking products operate under strict regulatory, security, and compliance standards, which require deep domain knowledge from the design team. The workflows are complex, covering onboarding, KYC, lending, payments, risk, and analytics, so generalist agencies often struggle. Specialized agencies understand how to balance user experience with safety, trust, and regulatory requirements.

2. What unique challenges exist when designing for banking and financial services?

Banking interfaces need to communicate trust and clarity while handling extremely sensitive financial data. Small UX mistakes can lead to user anxiety, support overload, or even compliance issues. The challenge is creating simple, intuitive journeys while managing complex backend processes and multi-step verifications.

3. How do product design agencies improve customer experience for banks?

A strong agency can redesign key moments such as onboarding, account management, payments, or loan applications to reduce friction and increase conversions. They introduce UX patterns that simplify decision-making, improve transparency, and build trust. Over time, this leads to stronger customer engagement and lower operational load on support teams.

4. What capabilities should a design agency have for banking-related products?

They must understand financial regulations, data permissions, authentication flows, and fraud-prevention requirements. Experience with dashboards, transaction histories, approval workflows, and secure multi-party systems is essential. They should also know how to structure complex information into clean, compliant, and emotionally reassuring interfaces.

5. How do agencies help with digital transformation for banks?

Banks often struggle with legacy systems, slow processes, and outdated UX patterns. Agencies bring modern design frameworks, modular systems, and scalable UI components that unify the experience across web and mobile. This accelerates internal transformation, improves operational efficiency, and raises the overall product quality.

6. How can an agency support both retail and corporate banking use cases?

Retail users need fast, intuitive flows, while corporate users manage multi-account structures, approvals, analytics, and bulk actions. Agencies with dual-domain expertise can create tailored interfaces for both, ensuring simplicity without compromising power. This helps banks offer a cohesive experience across all customer types.

Tank Design

Tank Design works with fintech and banking products where trust and clarity are paramount. Their approach focuses on minimizing cognitive load, reinforcing security cues, and presenting financial data understandably. Tank Design is particularly useful for products with high stakes interactions, like transfers, lending decisions, or risk disclosures.

Employees-to-Client Ratio (Bandwidth):

Senior designers per engagement.Process Maturity:

UX flows and financial logic refinement.AI Design Experience:

AI-assisted interaction insights.Client Communication (Meetings + Daily Updates):

Regular alignment.App/Web Dev Support:

Clear interface documentation.Office Culture:

Clarity-first.

Pixelmate

Pixelmate focuses on iterative usability refinement, ideal for banking products in early or growth stages needing quick feedback loops. They help teams improve interaction flows, reduce user hesitation, and refine transaction feedback cycles. Their agile approach lets product teams iterate quickly and responsive to user needs.

Employees-to-Client Ratio (Bandwidth):

Agile, responsive teams.Process Maturity:

UX mapping, interface design, iteration.AI Design Experience:

Pattern recognition and personalization cues.Client Communication (Meetings + Daily Updates):

Weekly syncs.App/Web Dev Support:

Build-ready handoffs.Office Culture:

Iteration-first.

Conclusion

Choosing a product design agency for banking-related products isn’t just about visual polish; it’s about trust, clarity, compliance, data communication, and safety. Banking UX should feel secure, intuitive, and transparent, even when dealing with multi-account flows, high-stakes transactions, or complex financial data.

Some agencies specialize in research and usability, others in data visualization or brand-aligned trust, and others in scalable systems and workflow design.

If you’re building or refining a banking product and want design that improves trust, reduces errors, and enhances clarity across financial experiences, Bricx is the right choice.

FAQs

1. Why do banking companies need specialized product design agencies?

Banking products operate under strict regulatory, security, and compliance standards, which require deep domain knowledge from the design team. The workflows are complex, covering onboarding, KYC, lending, payments, risk, and analytics, so generalist agencies often struggle. Specialized agencies understand how to balance user experience with safety, trust, and regulatory requirements.

2. What unique challenges exist when designing for banking and financial services?

Banking interfaces need to communicate trust and clarity while handling extremely sensitive financial data. Small UX mistakes can lead to user anxiety, support overload, or even compliance issues. The challenge is creating simple, intuitive journeys while managing complex backend processes and multi-step verifications.

3. How do product design agencies improve customer experience for banks?

A strong agency can redesign key moments such as onboarding, account management, payments, or loan applications to reduce friction and increase conversions. They introduce UX patterns that simplify decision-making, improve transparency, and build trust. Over time, this leads to stronger customer engagement and lower operational load on support teams.

4. What capabilities should a design agency have for banking-related products?

They must understand financial regulations, data permissions, authentication flows, and fraud-prevention requirements. Experience with dashboards, transaction histories, approval workflows, and secure multi-party systems is essential. They should also know how to structure complex information into clean, compliant, and emotionally reassuring interfaces.

5. How do agencies help with digital transformation for banks?

Banks often struggle with legacy systems, slow processes, and outdated UX patterns. Agencies bring modern design frameworks, modular systems, and scalable UI components that unify the experience across web and mobile. This accelerates internal transformation, improves operational efficiency, and raises the overall product quality.

6. How can an agency support both retail and corporate banking use cases?

Retail users need fast, intuitive flows, while corporate users manage multi-account structures, approvals, analytics, and bulk actions. Agencies with dual-domain expertise can create tailored interfaces for both, ensuring simplicity without compromising power. This helps banks offer a cohesive experience across all customer types.

As a remote-first team of UX specialists, we work exclusively with B2B & AI SaaS companies to design unforgettable user experiences at Bricx.

If you’re a B2B or AI SaaS looking to give your users an unforgettable experience, book a call with us now!

As a remote-first team of UX specialists, we work exclusively with B2B & AI SaaS companies to design unforgettable user experiences at Bricx.

If you’re a B2B or AI SaaS looking to give your users an unforgettable experience, book a call with us now!

As a remote-first team of UX specialists, we work exclusively with B2B & AI SaaS companies to design unforgettable user experiences at Bricx.

If you’re a B2B or AI SaaS looking to give your users an unforgettable experience, book a call with us now!

Author:

Unforgettable Website & UX Design For SaaS

We design high-converting websites and products for B2B AI startups.

Similar Design Agencies

Similar Design Agencies

Similar Design Agencies

Available for Work

Bricx

© Bricx, 2026. All rights reserved.

Available for Work

Bricx

© Bricx, 2026. All rights reserved.

Available for Work

Bricx

© Bricx, 2026. All rights reserved.

Available for Work

Bricx

© Bricx, 2026. All rights reserved.